Earn 5 Cash Back Each Quarter at Different Places Up to Quarterly Max When You Activate. When you use a balance transfer credit card you can save money by transferring an existing credit card balance to a new card that charges low or no interest for a period of.

Pros And Cons Of Balance Transfer Credit Cards Forbes Advisor

Balance transfer credit cards hold out promise for those struggling with debt.

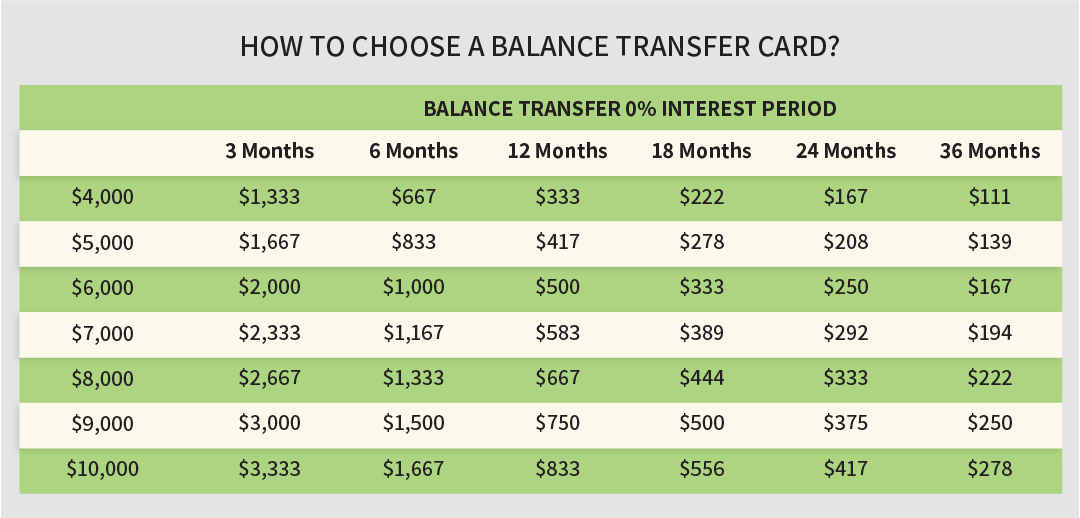

. Get 0 Intro APR for up to 21 Months. Balance transfers can help you pay down debt and avoid paying interest during a promotional period but they can involve transfer fees and unexpected costs. A balance transfer occurs when the outstanding balance of one credit card or several credit cards is moved to another credit card account.

Find the Capital One Card That Works Best for You and Start Your Application Today. Used wisely a balance transfer could help you take control of your. If you are considering a credit card balance transfer make sure to.

Find the Capital One Card That Works Best for You and Start Your Application Today. Ad Balance Transfer Offer - Enjoy 0 Intro APR for 21 Months on Balance Transfers. For some a 0 introductory rate on balance transfers can shave years off of debt.

Ad Enjoy 0 Intro APR for 15 Months on Balance Transfers and No Annual Fees. A credit card balance transfer allows you to move one card balance to another less expensive credit card. Ad Balance Transfer Offer - Enjoy 0 Intro APR for 21 Months on Balance Transfers.

A balance transfer is a type of credit card transaction that moves a balance from one credit card to another. Balance transfer credit cards for Fair credit. We provide the types of offers you can expect from a balance transfer credit card for fair credit along with steps to drive your credit score up.

A balance transfer is a process in which you transfer your existing credit card balances and debts to another credit card. A balance transfer is moving a debt balance from one account to another account. A balance transfer is the process of moving high-interest debt from one or more credit cards to a credit card with a lower interest rate.

A good balance transfer credit card can. A balance transfer credit card can give you an opportunity to pay down your debt without. A balance transfer involves the transfer of debt from one credit card to another with a lesser interest rate.

The most common type of balance transfer is shifting debt from one credit card to another credit card. The process of balance. Typically the balance being transferred is held on a credit card.

Ad Enjoy 0 Intro APR for 15 Months on Balance Transfers and No Annual Fees. Ad Find Credit Cards With No Interest Intro APR on Purchases Plus More Rewards. The name is relatively self-explanatory.

The balance transfer card should have a. A balance transfer is when you move money you owe from one credit card to another that charges less in interest. A balance transfer fee is the amount it costs to transfer the balance from one or multiple cards to another.

This is often done by consumers looking for a. Compare Card Offers Apply Online. Earn 5 Cash Back Each Quarter at Different Places Up to Quarterly Max When You Activate.

This fee can really add up with a large balance -- a 3 transfer fee on a 5000 balance is 150. Ad Looking for a great balance transfer card for high-interest debt. Determine the balance and interest rate of the card you want to pay off transfer This is a fairly straightforward process.

Preferably the debt moves to an account with a lower or 0 interest. Just log into your credit card account online. Balance transfers make the most sense when you have a plan in place to address your transferred debt.

This process is encouraged by. A balance transfer moves a balance to another account or card. Balance transfers work by shifting your debt from one credit card to another.

Ad Compare Balance Transfer Credit Cards w 0 Interest until 2024. A credit card balance transfer is the transfer of the outstanding debt the balance in a credit card account to an account held at another credit card company. It ranges between 3-5 of the balance.

When you apply you also enter the details of. Finally understand the credit requirements before applying. Pay off high interest credit card debt with these top-reviewed balance transfer cards.

The process is simple. Important notes about balance transfers. Balance Transfer Meaning Much like it sounds a balance transfer is the process of taking the balance of one or more credit card s and transferring it to a brand new credit card.

Commit to no new debt are sure you can afford the payment read the fine print and compare balance transfer options. Ad Find Credit Cards With No Interest Intro APR on Purchases Plus More Rewards. The balance of your old card is paid off by your new card effectively swapping who you have to.

What Does A Negative Balance On A Credit Card Mean

How Do Credit Card Balance Transfers Work

How Do Balance Transfers Work Nextadvisor With Time

/GettyImages-168262356-727bbf6ea0ef485394fab0b266acf752.jpg)

How Do Credit Card Balance Transfers Work

What Is A Balance Transfer Credit Card Discover

Top Balance Transfer Credit Cards May 2022 Mozo

What Is A Balance Transfer Credit Card Discover

How To Do A Balance Transfer With Citi Bankrate

Balance Transfer Credit Card Offers Are Making A Comeback These Are The Best Right Now

What To Know About Credit Card Balance Transfers Balance Transfer Cards Credit Card Balance Transfer Credit Cards

/dotdash-050214-credit-vs-debit-cards-which-better-v2-02f37e6f74944e5689f9aa7c1468b62b.jpg)

Credit Cards Vs Debit Cards Key Differences

What Is A Balance Transfer Understanding Balance Transfers Mbna

Pros And Cons Of Balance Transfer Credit Cards Forbes Advisor

Top Balance Transfer Credit Cards May 2022 Mozo

Top Balance Transfer Credit Cards May 2022 Mozo

Best 0 Apr Balance Transfer Credit Cards Of May 2022 Forbes Advisor

What Is A Balance Transfer Understanding Balance Transfers Mbna

What Is A Balance Transfer Credit Karma

:max_bytes(150000):strip_icc()/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)